From Blueprint to Bitcoin: An In-Depth Analysis of China’s Mining Machine Hosting Recommendations

In the kaleidoscopic world of cryptocurrencies, the journey from concept to tangible asset involves an intricate symphony of technology, economics, and innovation. China, a colossal force in the realm of digital currency mining, offers a fascinating blueprint for enthusiasts and investors alike. The country’s mining machine hosting recommendations stand as a testament not only to its dominance in blockchain infrastructure but also to the evolving landscape of global crypto ecosystems. Understanding this blueprint requires dissecting the multifaceted roles of mining machines, hosting services, and strategic economic policies that intertwine to create a formidable mining powerhouse.

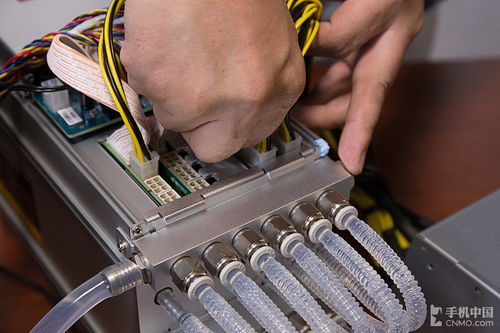

The cornerstone of cryptocurrency mining lies in the mining machine — the robust hardware designed specifically to solve complex cryptographic puzzles, thereby verifying transactions and securing the blockchain. In China, the manufacturing and operational edge provided by these mining rigs underpin a substantial portion of the Bitcoin (BTC) network’s hash rate. Mining machines, ranging from ASICs optimized for Bitcoin to GPUs leveraged for Ethereum (ETH) and other altcoins, thrive within a hosting environment that guarantees optimal performance and electricity efficiency. This delicate balance between power consumption and computational output is the heartbeat of a profitable mining operation.

Hosting mining machines, often in large-scale mining farms, has emerged as a strategic solution to common industry bottlenecks. These farms aggregate thousands of units, utilizing state-of-the-art cooling systems and secure electrical frameworks to maximize uptime and minimize operational costs. For Chinese miners, hosting services provide a shield against the volatility of grid power fluctuations and regulatory interventions. Moreover, centralized hosting enables sophisticated energy purchase agreements, often tapping into renewable resources like hydropower, which is abundant in regions such as Sichuan and Yunnan. This shift towards greener mining supports both sustainability goals and cost reductions—critical factors when mining margins are razor-thin.

Bitcoin’s dominance as the premier cryptocurrency attracts vast mining interest, but with evolving algorithms and network demands, ETH and emerging coins offer diversified avenues for mining operations. Ethereum’s transition towards Proof-of-Stake (PoS) mechanisms, however, foreshadows a changing paradigm where traditional mining might contract, pushing miners to adapt or pivot toward other proof-of-work coins. This flux presents opportunities to tailor mining rig deployment strategies; some miners opt for multi-algorithm rigs, capable of switching hash computations based on profitability indices employed by real-time market analysis tools.

Yet, the complexity does not end at hardware and hosting. The economic ecosystem encompassing exchanges and token markets plays a pivotal role in determining mining strategies. Chinese miners, operating under intense regulatory scrutiny, are adept at navigating cryptocurrency exchanges—spot and derivatives—to hedge price fluctuations and optimize earnings. The fluidity of assets like Dogecoin (DOG) and their speculative popularity inject a layer of emotional trading impacts that miners must monitor, balancing between holding mined tokens for long-term appreciation and converting them swiftly for operating capital.

Furthermore, the interplay between mining and blockchain networks underscores the importance of software optimization and firmware innovations. Leading Chinese mining corporations continuously update ASIC firmware to enhance hashrate efficiency and reduce failure rates. This relentless innovation cycle fosters competitive advantages, especially as distribution globalizes and other regions attempt to challenge China’s prevailing dominance in mining. The role of mining pools, frequently headquartered in China, aggregates smaller miners, offering a collective bargaining power and reliable payout schemes that democratize access to the otherwise capital-intensive mining world.

Looking ahead, China’s blueprint for mining machine hosting is both a lesson in industrial foresight and a dynamic shelter amidst cryptocurrency markets’ volatility. As miners worldwide grapple with fluctuating network difficulties and regulatory environments, these hosting recommendations illuminate paths to stability and scalability. The confluence of cutting-edge mining rigs, efficient hosting infrastructures, and savvy economic orchestration sets a high bar for international mining competitors.

The synergy between technology and policy, particularly in regions rich with cheap electricity and governmental support, propels mining farms to a new plane of operational excellence. The strategic decision to centralize mining machines in hosting farms balances resource allocation and risk management, allowing miners to flexibly respond to blockchain network changes, from Bitcoin’s halving events to Ethereum’s anticipated network transitions. Such agility distinguishes successful mining operations from those facing obsolescence.

In conclusion, China’s mining machine hosting blueprint offers more than just a technical guide—it embodies an evolving narrative of adaptation, resilience, and strategic ingenuity. Whether you are a miner deploying rigs, an investor eyeing Bitcoin and Ethereum opportunities, or an analyst watching the shifting tides of cryptocurrency landscapes, China’s model highlights critical pathways to harness crypto mining’s potential. As blockchain technology marches forward, the legacy forged by Chinese mining hosts and machine manufacturers will undoubtedly influence how the global community approaches crypto asset generation and the sustainability of decentralized finance.

Leave a Reply